Simple Ways To Earn Money 2025

Invest your savings by yourself and start making money.

There are two types of investing: active and passive. The former involves attending investment conferences, researching different stocks, and trying to decide which one to pick. Active investing is quite a rigorous process since you need to do the research yourself and make cost-benefit comparisons while being sure not to get carried away with excitement.

This can all be done on your own, but why would you want to? Passive investing is a much less intense way to invest because it relies on the work of others—online Robo advisors—to do all the heavy lifting for you (and usually does better). But how does that translate to a real-life scenario? Let’s check out some simple Ways To Earn Money in 2025.

I currently invest with Nutmeg and have done so for years; they have a handy app, and I have both a LISA and a stocks and shares ISA. These are both managed for me (so experts invest for me for a small fee). I feel safe doing this, as they know best! So far, my investments have gone up and up, so I’m very happy!

If you are looking at other ways to invest, check out Up The Gains – Lots of insightful knowledge, including the best apps to use, beginner’s guides and more! Click here to read

Sell your unwanted items online and make some cash.

To make some quick cash, consider selling your unused items on eBay, Vinted, or Facebook Marketplace. If you have good photos and a clear description of the item you are trying to sell, many people will be willing to purchase the item from you. Consider also having a car boot sale in your driveway or on the street.

You will most likely not be able to sell everything you want to get rid of at once, but it’s better than nothing. Additionally, don’t forget to look into using local Facebook groups that deal with trading and sales.

The Penny Pincher has some fab ways to sell your stuff and top up your bank account! Check out their blog here

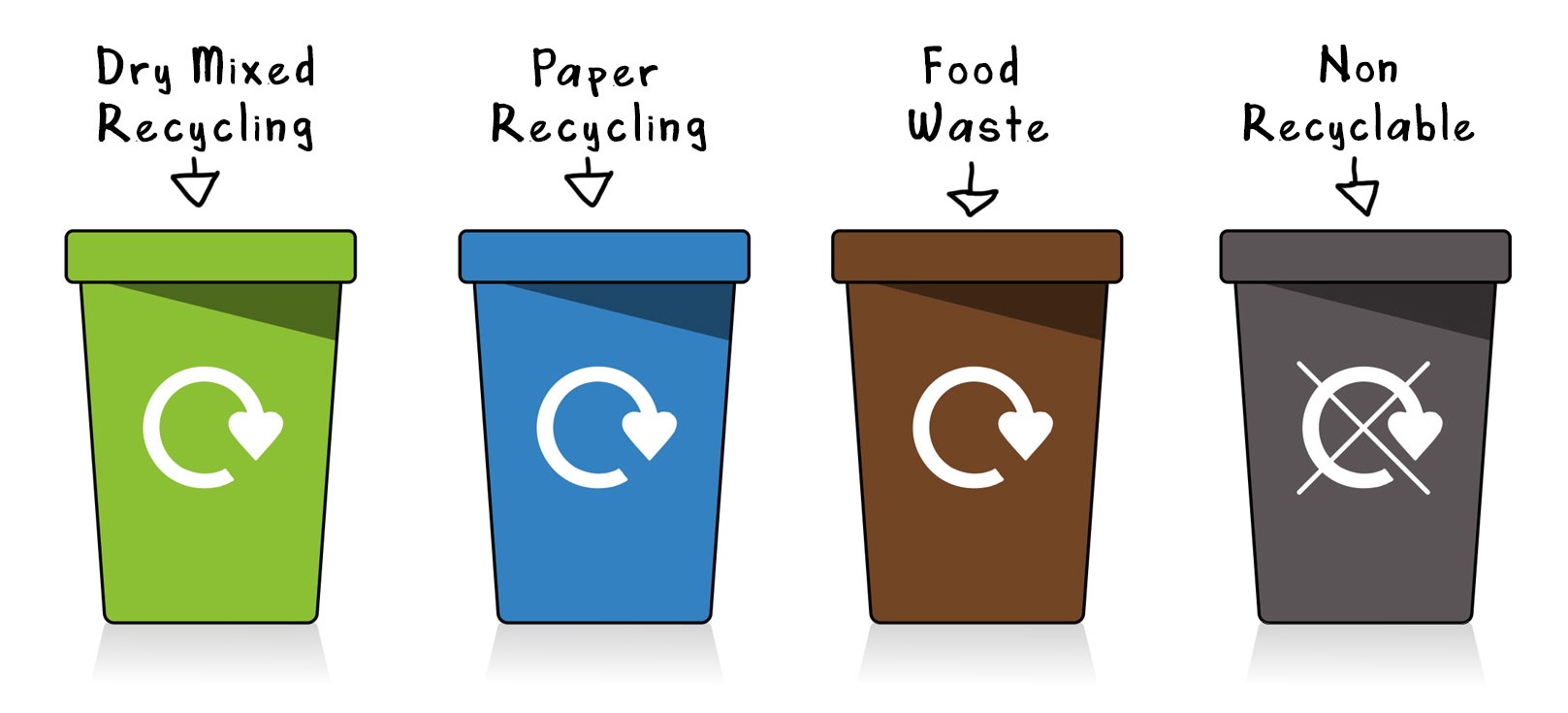

Recycle old or used items.

You can make money by recycling your old or used items.

There are many ways to recycle, including:

- Selling them.

- Donating them to charity.

- Recycling them for cash at a recycling facility.

For example, you can recycle scrap metal and earn money from it. You can also recycle old clothing for cash online or in person at a resale shop.

Do some freelance work on Fiverr to earn extra money.

Have you heard of Fiver? It is a simple platform where you can offer your services to people for a fee online. This can be anything such as graphic design, VA, admin, SEO work, Blog writing and Website design.

It’s easy to sign up and offer your skills. But there are some tactics that you can use to make your freelance work more appealing and compelling, especially if you’re just starting.

- Do your homework. It’s important to have a good idea of what kind of work is currently in demand among artists and what kind of projects will appeal to people who like your particular style. This means reading up on the kinds of things others are doing in your genre (art vs. design, illustration vs writing, etc). It also means reading about the business side of freelancing (what types of projects are popular for freelancers? How do most freelancers make money?)

- Reviews are everything! Make sure when you first start that you offer some services a bit cheaper to build up your reviews.

- Practice makes perfect – maybe practice before offering these tasks to family and friends, so you get to know what to do and the best way you can deliver this.

Open a side business on Etsy

If you’re good at sewing, you could turn your hobby into a business by tailoring clothing or making custom costumes on Etsy.

The first step in opening a new business is to plan. Do some research and make sure the market is ready for what you want to offer. Think about how your company will be different from others already in the space and try to find an area where you can fill a gap in the market with your product or service.

And remember, it’s important to choose something that interests you so that running the business won’t feel like work!

Once you know what type of business idea interests you most, start looking into competitors. Don’t just look at what they’re doing now – consider reviews from potential customers as well!

This will help ensure that once your company launches there are high expectations for it: if not everyone has heard about this product yet (or worse yet – people have started complaining), then things may get off to a rocky start during those initial sales phases before word spreads widely enough through social media buzzword “going viral”.

Sign up for a rewards credit card.

As a newbie, earning frequent flyer miles and points is the most endearing thing to me. I’m also lucky enough to travel often, so I have an affinity for rewards credit cards that can be used with Amex and Chase.

To get started with a rewards credit card program by signing up for one of the big three credit card third-party companies (American Express, Discover, or MasterCard), you must understand what differentiates the cards in terms of rewards.

You need to do your research before signing up for any credit card to make sure you’re not paying more than necessary in fees. So it’s important to ask around about which reward cards give you the most value for your money and/or get you the best return on investment (ROI).

Many factors influence how much a reward will cost you (such as the annual fee, cashback rate and percentage of spending categories where points can be redeemed, such as groceries or travel), so finding out all you can about these fees is crucial if you want to keep your costs down.

Look for simple ways to earn money by doing things you do anyway, like watching TV or shopping online.

Browse the Internet and earn cash. There are ways to make money on the things you do every day, like browsing the web. Browse with Swagbucks and get paid for searching the web, playing games online, watching videos, shopping, and more.

Get yourself a part-time job.

There are many ways to earn money, and some of the ways that are not widely known are explained below.

It is also very important for you to know how much money you will make with your startup business. The amount of money you make depends on the type of business you choose.

The first step in your startup business is to find out how much money you need to start it.

To do this, you should use a tool called “How much does a new car cost?” or “How much does a new home cost?” The tool will help you determine how much money you need to start your business.

The second step is to decide what kind of business you want to do. You can choose between starting a café, opening an online store, or creating an app.

The third step is to decide what kind of equipment and tools you will need to get started with your business. For example, if you want to open a café, then the equipment and tools that will be needed will be coffee machines, tables, chairs and so on.

Be mindful of how you spend your money.

To get a hold of your finances, take a full week to track where you spend money and how much of it. For example, if you know that you eat out most days of the week, consider tracking your meals.

If you know that you treat yourself to luxuries like getting your nails done or having someone cut your hair, track those expenses as well.

Once you have tracked everything for a week, review it and identify areas where there is excess spending that you can cut back on. You could be surprised at how much money is going toward things like bubble tea and iced coffee!

Once you’ve identified ways to reduce your spending (and hopefully keep them up over time), see how much money you can save in this way.

This may mean cutting out an unnecessary luxury expense of buying new clothes every month or trading in Starbucks for brewing coffee at home, but the return on investment will be well worth it in the long run! If possible, invest any money that is being saved into a high-yield savings account or CD so that it continues to grow over time.

Here are some savings trackers to get you started

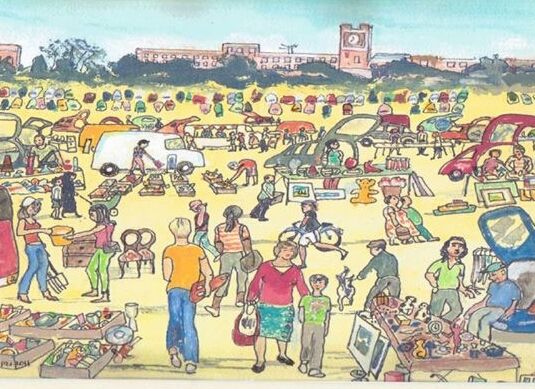

Have a car boot sale and clear out some clutter in the process.

A car boot sale is a great way to get rid of some clutter while earning money. There’s no need to hold an event as big as this in your front garden; you could also take your unwanted items to a local car boot sale instead.

At the end of the day, anything that hasn’t sold is likely to get thrown away, so why not make some money from it? Make sure you check the rules of your local car boot sales first, and be sure to price everything sensibly!

Apps like Music Magpie will help you sell old CDS, DVDS and games for cash. Alternatively, if you have some unused mobile phones or gadgets lying around, then sites like Cex are worth looking into (it may be worth browsing other sites too).

Try these simple ways to earn money in 2025!

Want to fatten up your bank account? Try taking these steps towards earning more money:

- Saving money, rather than spending it as quickly as you can get your hands on it, is a crucial step in making your money work for you. Putting some aside will give you peace of mind, knowing that should something unexpected happen, like a sudden job loss or a medical emergency, you’ll have something to fall back on.

- Whereas saving entails keeping your money safely stored away and liquid (easily accessible), investing includes putting your cash into more risky ventures with the expectation that they’ll pay off in the long run. Some examples of investment opportunities include stocks, bonds, and real estate. If you opt to go this route, make sure that it’s something you’re comfortable with before diving headfirst into any risky financial waters.

- It’s also very important to be mindful of how and when you use your credit cards. Avoid charging everything; instead, save them for emergencies only. You don’t want to end up with a mountain of debt that could take years to pay off!

- Get signed up for the survey sites I suggest. You can earn a lot doing these in your free time! Survey Sites

- Read books!! Or podcasts. I have started learning so much from just reading books that inspire and educate me. I recommend these books I recently read for developing your mind and money management. Best-selling Finance books

If you want a few more tips and tricks for making extra money from home, check out this blog post by Karen. She explores effective strategies that can help you use your skills and resources to maximise your earning potential and achieve your financial goals by making money from home.