Sinking Funds – What Are They?!

Have you ever heard of sinking funds?! I know I hadn’t before starting my financial freedom journey. I only set mine up this year – and I wish I had started sooner! A sinking fund is a way to mentally and physically allocate your money to protect you and your peace of mind.

.

For me, I have always felt guilty about spending money. I don’t know why or where it stems from, but it’s really hard for me to buy treats, days out or anything fun! Sinking funds enable you to take small, manageable steps toward your ultimate goal,

In my opinion.

What is a Sinking Fund?

They are basically ‘pots’ of money that you create- either by an app on your phone, your bank or in cash. You set a goal amount and the types of funds you want to have – this is totally personalised to you, as everyone has different goals and interests.

Pick an amount that you’d like to contribute to your sinking fund every month and make sure to make those monthly deposits. You can automate your savings by setting up a standing order from your main account into your sinking fund account to make this process even easier.

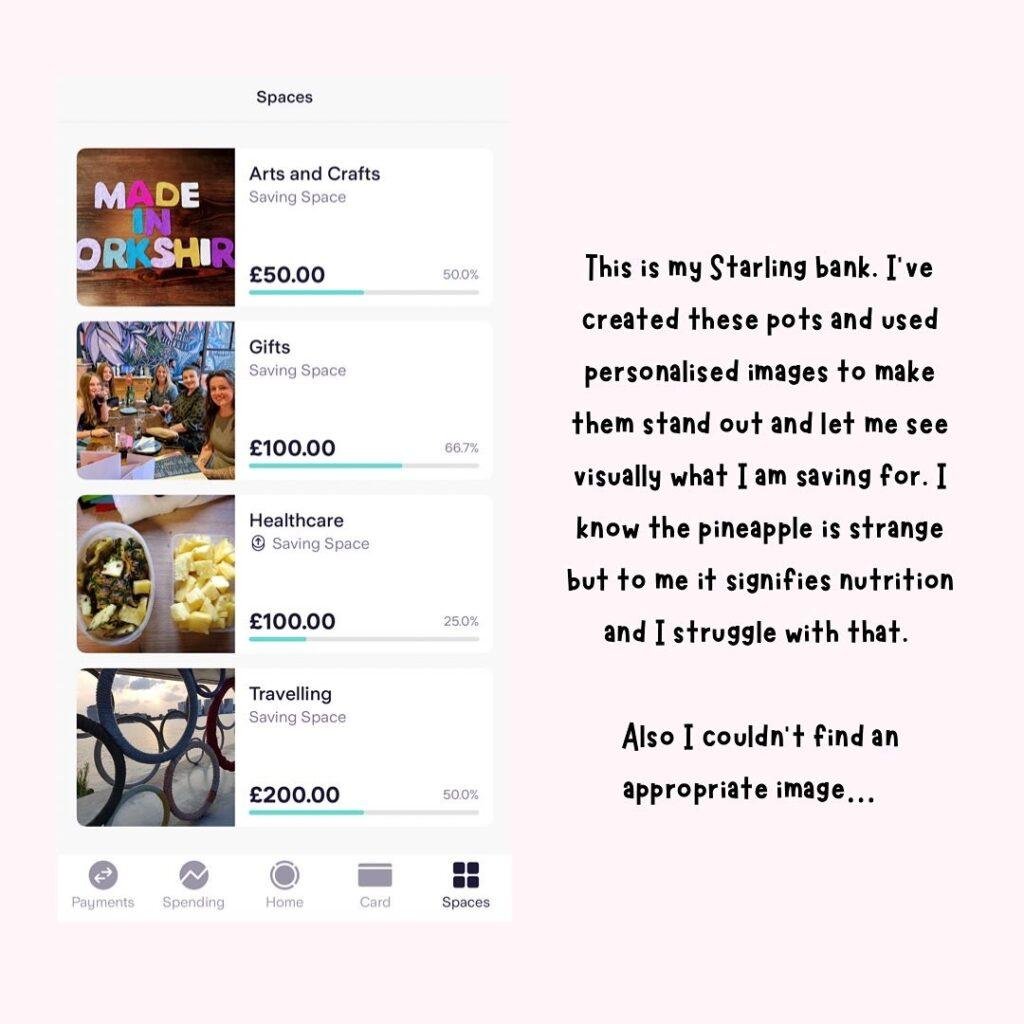

I have four sinking funds at the moment, all set up in my Starling Bank account. You can personalise these and add photos to keep you motivated. They are called ‘spaces’ in Starling.

I know a few other banks also have these now, such as Monzo and Natwest.

To work out how big your sinking fund should be, go through this process:

- Write down all of the costs you anticipate

- Estimate how much each will cost

- Work out how many months you have to save

- Divide the total amount by the number of months you have to save the money

- This is how much you need to put away each month

Examples of a Sinking Fund

Some commonly

known upcoming expenses include:Vehicle purchases or financings

Car repairs or maintenance

Hobbies and Interests

Buying new furniture

Saving for Holiday

Holiday gifts and travel

Paying self-employment taxes

A big event, like attending a wedding or a big birthday

Healthcare

School uniforms

Pets

Household expenses – this includes expenses you know are unavoidable, so as when your boiler needs replacing.

These are just a few to get you started. Really, you can use a sinking fund for many other types of expenses. They are personalised, and that’s the great thing about them.

If you want to learn more about them,

I suggest giving More Than A Mummys complete guide to sinking funds for beginners.