Passive Income in the UK in 2025

What is passive income?

Passive income is any money you make from your business that doesn’t require your direct involvement. This can be anything from selling products online to renting out rooms in your home on Airbnb or letting out a car on Karshare.

The State of Passive Income in the UK in 2025

In the UK, passive income is on the rise. It’s estimated that by 2025, over 1 million people will be earning money from their investments and other passive income sources.

The main reason why this type of income has become so popular is that it allows you to make money while you sleep! This means that if you want to get rich quickly or quit your job for good, investing in your future with passive income can help make this happen sooner rather than later.

Types of Passive Income

The first type of passive income is investment income.

This includes:

- Dividends paid by companies you own shares in, such as Apple or Amazon

- Interest on bonds or savings accounts that you own

The second type of passive income is rental income. This includes: - Renting out your house or apartment to other people, either short-term (like Airbnb) or long-term (like traditional renting). You’ll need to pay taxes on this money if it’s above the threshold for self-employment tax (which is £1,000 per year).

Tax Implications of Passive Income

When it comes to tax implications, there are a few things you should know. First, passive income is taxed at different rates depending on its type:

- Dividends are taxed as ordinary income and therefore subject to your marginal rate of income tax (the highest rate you pay).

- Capital gains from stocks or shares held for more than 12 months are taxed at 20% (or 10% if you’re eligible for Entrepreneurs’ Relief).

- Interest earned on bank accounts is also treated as ordinary income and therefore subject to your marginal rate of income tax (the highest rate you pay).

How to Generate Passive Income

There are many ways to generate passive income. The first step is to determine what kind of investment you want to make, based on your risk tolerance and goals. Some options include:

- Investing in stocks and shares (e.g., through an online broker such as eToro)

- Investing in real estate (e.g., buying a house or renting out a property)

- Investing in bonds (e.g., corporate or government)

- Investing in mutual funds or index funds

If you’re looking for something more creative, consider peer-to-peer lending platforms like Funding Circle where you can lend money directly to individuals and businesses at competitive rates while earning interest on their repayments!

It’s an excellent way for investors who have some cash lying around but don’t want anything too risky/complicated/time-consuming so this could be ideal for those wishing to build up their portfolio over time without having much knowledge about financial markets/economics etcetera.”

Risks of Generating Passive Income

There are many risks associated with generating passive income, which is why it’s important to be aware of them. These risks include market volatility, liquidity, inflation, and political risks. Currency risk is also something to consider when investing overseas as the value of currencies can fluctuate significantly over time.

Maximising Passive Income in the UK

Diversification: This is the key to generating passive income. You don’t want all of your eggs in one basket, so to speak, as this can result in a loss of capital if something goes wrong with one of your investments. It’s best to spread out your investments across multiple asset classes and industries so that if one area fails, there will be others that succeed instead of taking a hit as well.

Tax optimisation: While tax optimisation isn’t technically a strategy for generating passive income (it’s more like managing what you already have), it’s still an important part of creating wealth through investing strategies like those outlined above because it allows investors who qualify for certain tax breaks or deductions on their investments more money back from Uncle Sam than they would otherwise get without taking advantage of these benefits

The following are examples of successful passive income earners in the UK:

- The founder of a successful online business that sells products. He earns an average of £10,000 per month from his website and has been doing so for the past five years.

- A woman who owns a small chain of restaurants, earning between £5,000 and £10,000 per month from each restaurant she owns. She also runs a catering service and sells food at events around town on weekends to supplement her earnings.

Best Practices for Generating Passive Income

- Develop a long-term strategy.

- Identify your goals and how you want to achieve them.

- Invest in yourself by learning new skills that will help you generate passive income streams.

- Find out what the market needs, then offer the solution at an affordable price.

Conclusion

The potential for success in the UK is huge. It’s one of the most advanced economies in the world and has a population of more than 65 million people, which means there are plenty of opportunities to find customers and clients.

The first step to earning passive income is to start learning about it–this guide has provided you with everything you need to get started!

If you want to learn about other ways to earn a passive income have a look at my other posts

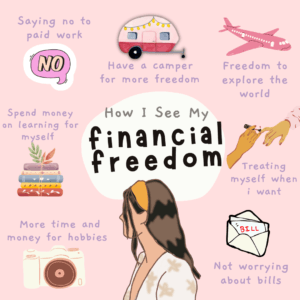

Creating Your Financial Freedom

Before you go, make sure to check out these related blog posts that offer valuable insights on additional cashback sites you can explore.

Some articles on this blog contain affiliate links, which may earn me a commission to cover my running costs.