Make Money with RedWigWam

Make Money With RedWigWam Mystery Shopping

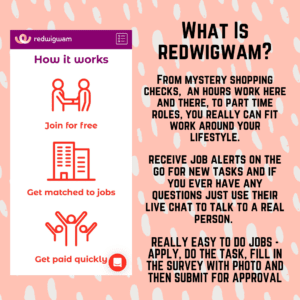

What is Redwigwam?

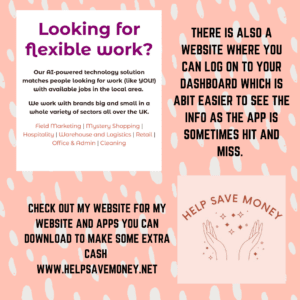

RedWigWam brings hirers and workers from across the UK together for part-time and temp roles. These roles can last between 30 minutes and up to a couple of months, and require a range of skills. RedWigWam take your skills, jobs, location and available time and shows you the jobs which match you! Let’s see how to Make Money with RedWigWam.

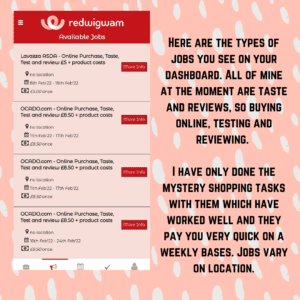

I downloaded the app last year during Lockdowns, and have so far completed about 10 jobs with them and earned up to £200. The jobs I have completed are

- Merchandise

- Quick In-Store Stock Check

- Taste and Review

- Online Product Reviewer

My favourite jobs with RedWigWam have been to purchase a product from Co – op. I got to keep it and test it out at home. I didn’t even need to review them, which you do with most companies!

Other Temp jobs sometimes come available – these include:

- Commercial Cleaners

- Pick Packers

- Warehouse Operative

You will have your dashboard (which is better on the website for viewing everything) and see your weekly timesheets, the jobs available, your ID badge to show stores if needed and also E-learning, which allows you to train in things such as –

- Bartending, Cleaning,

- How to boost your LinkedIn CV

- Digital Marketing Skills

- Ratings and Reviews Courses

Filling in your profile

Filling in your profile lets them know who you are, where you want to work, how long you can work for, how far you want to travel and what skills you have.

Filling in your profile lets them know who you are, where you want to work, how long you can work for, how far you want to travel and what skills you have.

Why do they need this information? – This information is so they can match you to jobs in your area

Bank Details – they need your bank details to pay you! – You can fill this in when you find a role that you want to work in.

Payments

All payments are made by bank transfer, which is why they need these details from you when you register. Also, here is a bit of info from their website about Paying Tax –

Because we try to do the right thing, we employ all of our workers directly and always pay legal obligations such as National Insurance, Tax and Holiday Pay.

If you are paying tax, but don’t think you should be, it’s best to contact HMRC.

BUT:

If you’ve told us you have other employment, you’ll automatically be placed onto a BR tax code. This is because HMRC allocates all of your tax allowance to your first job regardless of how much you have earnt. If, by the end of the tax year, you have paid too much tax, you can expect a rebate. This will come direct from HMRC if applicable.

If you haven’t completed the P46 section of your profile, we will use the BR tax code until either the worker completes the section or HMRC send us a new tax coding notice to correct it.

Happy RedWigWamming!!!